About Steptrade India Fund

Steptrade India Fund - GIFT City Ghandhinagar

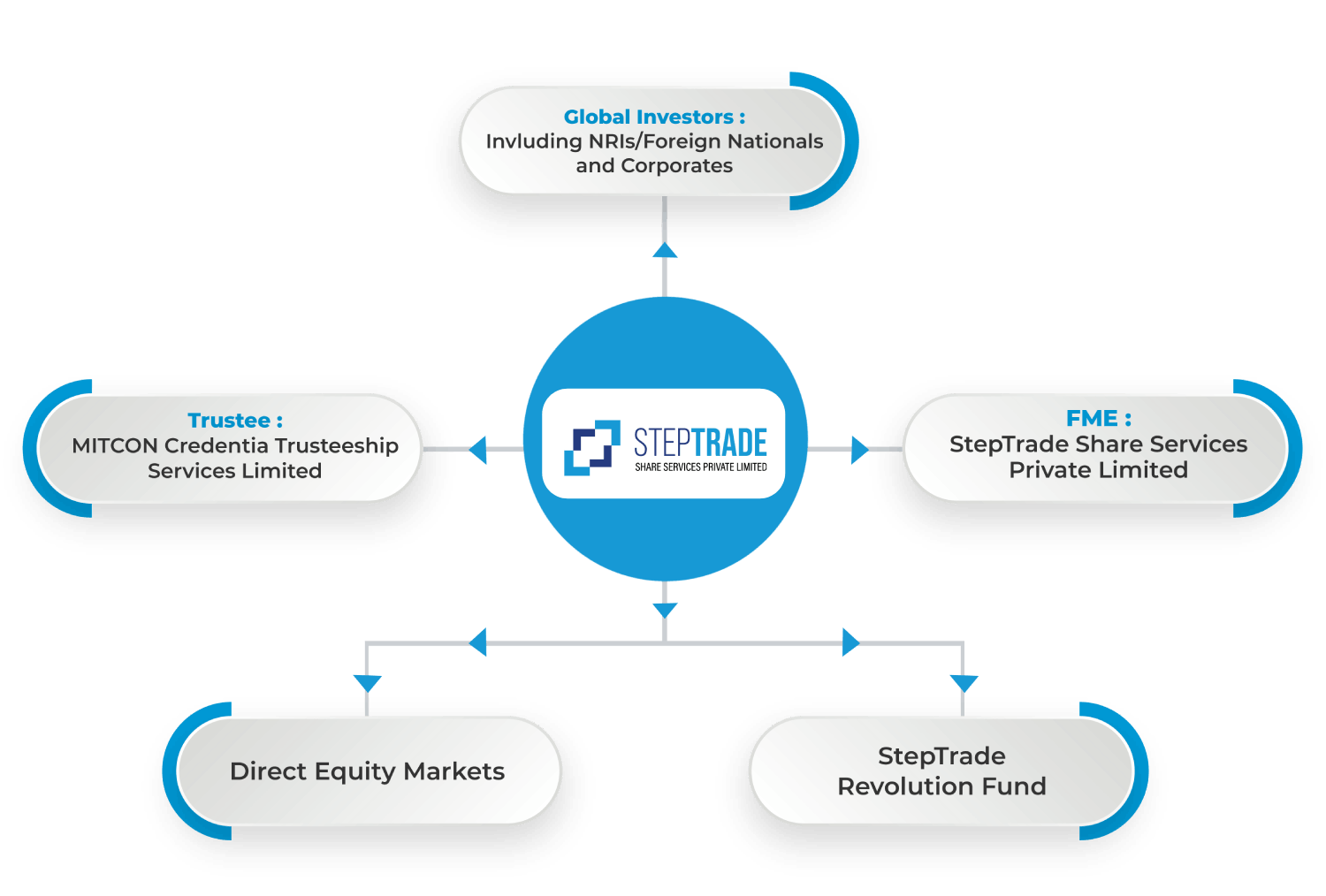

Steptrade India Fund, an open-ended Category III Restricted Non-Retail Scheme AIF, is established under IFSCA FM Regulations and operates from the GIFT International Financial Services Centre (Registration No. IFSC/AIF3/2024-25/0162). Launched by Steptrade Capital, this fund exclusively serves private and accredited investors, providing unique opportunities to invest in India’s growth sectors.

With a Category I Foreign Portfolio Investor (FPI) license, Steptrade India Fund offers diversified investments in NSE and BSE-listed companies, as well as entities listed on the GIFT Exchange. Additionally, the fund has a strategic stake in Steptrade Revolution Fund, a leading SME and Microcap-focused AIF, positioning it to capture growth opportunities across India’s small and emerging enterprises. Investors can participate in anchor investment opportunities and Qualified Institutional Buyer (QIB) allocations, reinforcing their engagement in India’s high-potential markets.